Enterprise Risk Management-NorthArm Advisory Services

Enterprise Risk Risk Assessments Controlling Risks Training Strategic Risk

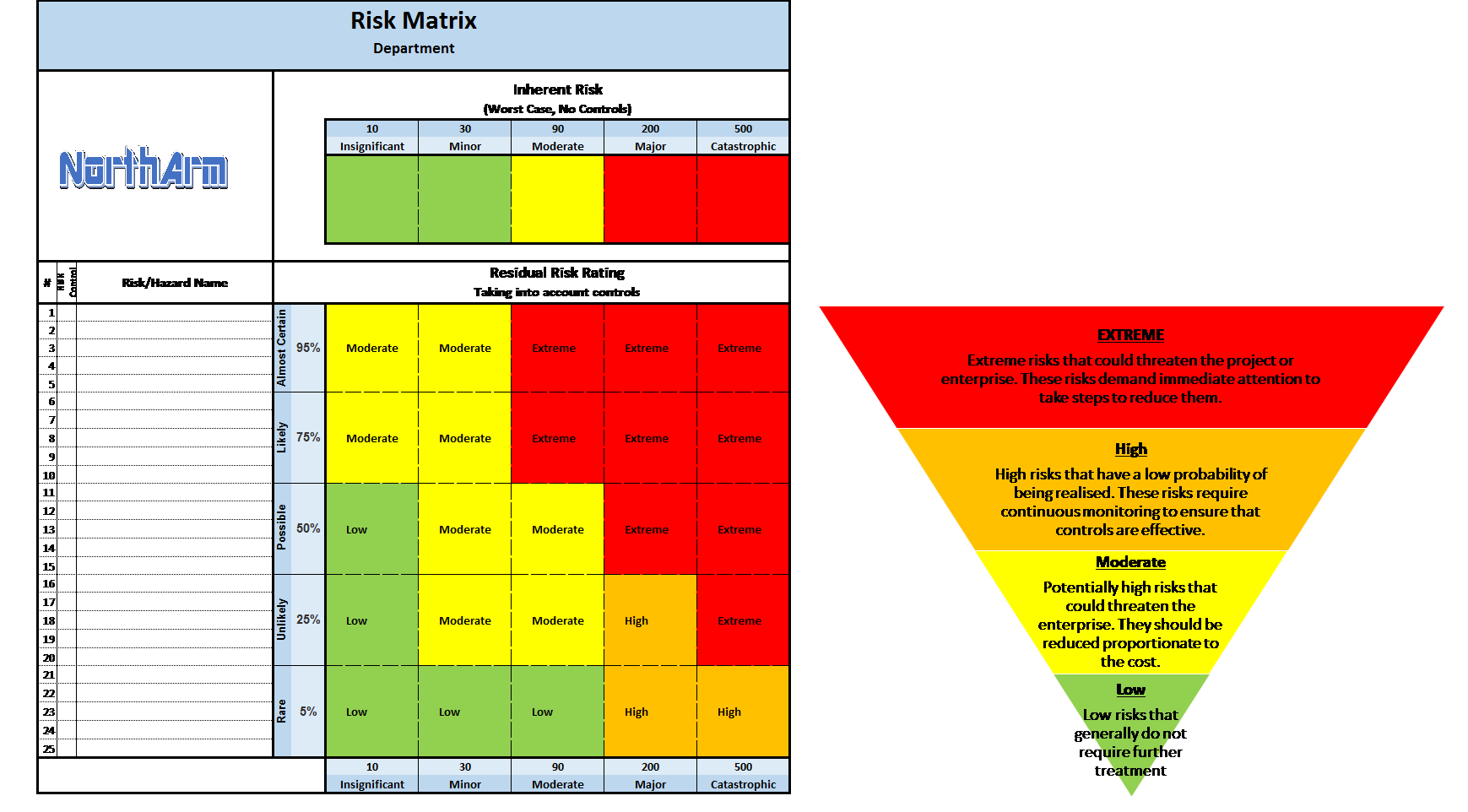

Enterprise Risk Management supports the achievement of an organizationís objectives by addressing the full spectrum of its risks and managing the combined impact of those risks as an interrelated risk portfolio. It encompasses all areas of organizational exposure to risk (financial, operational, reporting, compliance, governance, strategic, reputational, etc.). Business leaders today are addressing many challenges and opportunities in today's growingly complex finance, operational, and market environments.

†

NorthArm can assist an organization to design it's risk management framework based on ISO 31000 principles, as outlined below.

Risk Management Framework

The Risk Management Framework should be embedded within the organizationís overall strategic and operational policies and practices. It provides a structured process for the management of all risks, whether those risks are primarily quantitative or qualitative in nature. And if implemented properly, a risk management process through the risk management framework facilitates continual improvement of the organization.

†

Source: ISO 31000

The risk management framework should enable Risk Management to:

Elements of this include: